Kathmandu, Aug 15: Finance Minister Dr Prakash Sharan Mahat has said although country’s economy is improving in recent period, positive concept has not been developed among the general people and private sector.

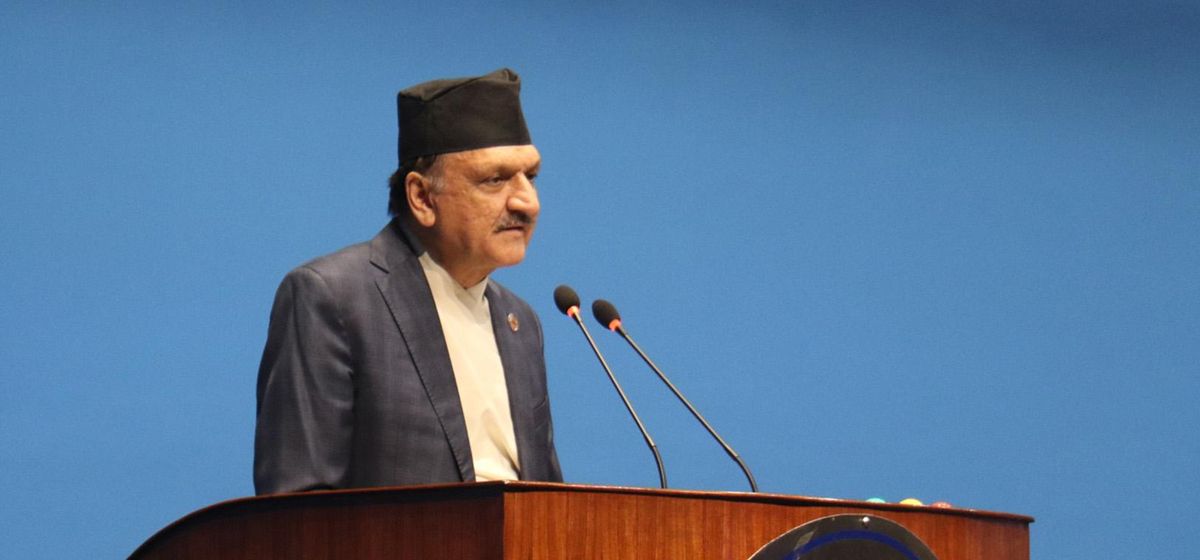

At an inauguration of ‘Management Seminar 2080’ organised by the Department of Inland Revenue here today, Finance Minister Mahat expressed concern over negativity dominating the private sector.

“Now, the economy is heading towards positive path. A positive concept should be developed that we have to move towards positive path and we can. But a trend of thinking negativity from all sides was seen”, indicating towards the private sector, Finance Minister Mahat mentioned, “Efforts are underway to improve the economy and positive results are being seen.”

Saying the umbrella organisations of the private sector and their office-bearers have to make the similar opinion about the situation of the economy, he suggested the organisations for the same.The Finance Minister further said the private sector is focusing its attention only in business and it has not been able to take benefit even though the government has adopted a policy to increase domestic production.

He directed the employees of revenue offices across the country to carryout activities being responsible to meet the revenue target set by the government in the current fiscal year.On the occasion, Arjun Prasad Pokharel, Secretary at the Ministry of Finance, said that the government’s revenue collection target for the current fiscal year could met by increasing the tax base. The government, according to him, is hopeful that the taxation system in Nepal would improve through systematic development and capacity building of the employees.

“The cost of the revenue collection has increased. We need to get rid of manual style of working unlike in the past. We need to optimize technology,” said Finance Secretary Pokharel, urging the concerned authorities to emphasize implementation of the new provisions in the Financial Act.He also called for addressing the concerns raised by the report of the Auditor General, CIAA and effectively implementing the decisions of the Revenue Tribunal, Kathmandu.

Similarly, Rajendra Malla, Chairperson of Nepal Chamber of Commerce, observed that the government could meet its revenue collection target if the scope of tax is extended rather than its base.Stating that a huge number of enterprises and individuals were still out of the ambit of taxation system, he pointed out the need to bring them under the ambit.

According to him, 40 per cent of goods were being imported in the market through ‘Grey Market’. Hence, he stressed that it should be brought under the scope of taxation. “One-door policy should be implemented apart from the enforcing the provision of issuing PAN number along with the citizenship identity card,” he said.Likewise, Birendra Raj Pandey, Vice-Chairperson of the Confederation of Nepalese Industries, said that the morale of private sector was down at the moment and thus said that it should be boosted.

According to him, the taxation system of Nepal should be manufacturing-oriented than import-oriented.

Similarly, Anjan Shrestha, senior vice-President of the FNCCI, worried that there were no signs of improvement in the national economy in the current fiscal year. “Taxes in Nepal are higher than other countries in the South Asia. The growth rate of revenue is negative as compared to the growth rate of the gross domestic product (GDP),” he said.